“Anything that is measured and watched, improves.” – Bob Parsons.

When was the last time you had a health check? Probably not recently enough.

While we tend to take a very DIY approach to our personal health – a common cold often (mis)diagnosed as the new Black Death – the health of your customer base should be more accurate, and neurosis-free.

Think of a customer audit as you would an MOT.

A regular check lets you peek beneath the bonnet, spot the dodgy steering and stop your ecommerce machine from veering off piste.

Like a stethoscope to a beat, we’ve put together a fundamental list of metrics you should be keeping an eye on, what they tell you and what you can do with all this beautiful data.

NB: Benchmark your metrics against the retail industry/your niche to understand your results with a nice slice of context.

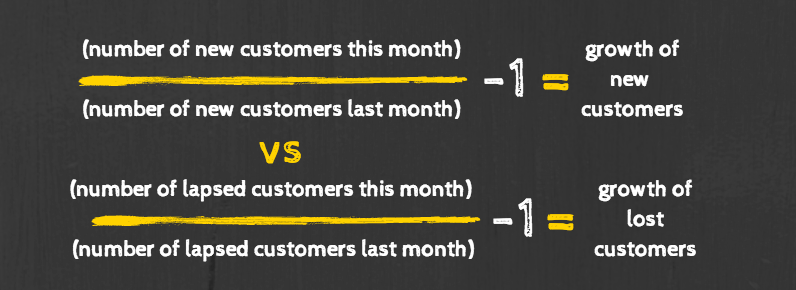

Ideally, the rate at which you acquire customers should be greater than the rate at which you lose customers.

This metric is very simple to calculate and gives you a very easy measure of how your business is evolving in terms of its customer base.

When looking at figures such as these, one should never neglect the age-old ecommerce mantra: your existing customers are worth more than new customers. Consequently, one of the most important metrics to pay attention to is your growth/change in lapsed customers.

It costs six to seven times more to acquire a new customer than to retain an existing one. Moreover, the probability of selling to an existing customer is between 60% and 70%, compared to a 5% – 20% chance with a new customer, according to Digital Velocity.

Dosage: repeat quarterly

This equation is pretty basic when you consider the seasonal ebbs and flows of business throughout the year – with many retailers cashing in and gaining more customers at certain dates – so keep an eye on quarterly results and compare figures annually to give a broader direction of success.

Further reading:

Well this is pretty self explanatory, right?

Loyal, active customers are the bedrock of any successful, sustainable ecommerce businesses.

It might seem like a given, but keeping an eye on your active customers is an essential metric for ecommerce success.

The definition of an “active” customer varies from business to business; taking into account formulas such as order gap (discussed below) will help you determine the parameters of an active customer.

Dosage: repeat once a month

Further reading:

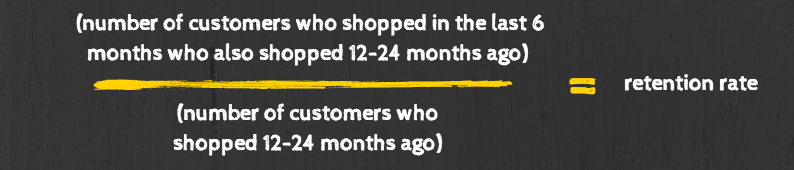

What it tells us: (very) basically, your customer retention rate is a key metric that shows the proportion of customers that have stayed with you and (typically) have long-term loyalty. You could call it the opposite of customer churn.

It’s a key factor to help you understand how good your business is at keeping active customers, shopping.

For instance, if a thousand customers shopped during the period of 12-24 months ago and 200 of those customers shopped again in the last six months, then your retention rate would be 20%.

Benchmarking retention, as discussed, is relative to the nature of your business and market, and will vary dramatically by cost/type of product.

In a perfect world a 100% retention rate would be nice, however the reality is that people churn – get used to it, but don’t get complacement with it!

Why is customer retention so important? According to Bain & Co, increasing customer retention rates by just 5% increases profits by 25% to 95%.

Moreover, from a marketing perspective, existing customers offer far greater possibilities because you know more about them.

We can provide highly personalised, relevant, and tailored experiences for our customers, as we have their preferences and profiles.

Dosage: repeat once a month

Further reading:

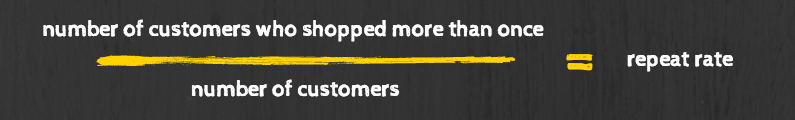

What it tells us: the proportion of customers that have shopped more than once.

Suppose you have 100 customers, of which 23 have shopped more than once, your repeat rate would be 23%.

According to Adobe, marketers have to bring in seven shoppers to equal the revenue of one repeat purchaser.

Studies have shown that on average around 14% of shoppers are repeat customers. However, the NRF has shown that a benchmark figure from the best performing sites is around 40%.

Personalisation is fundamental in boosting repeat rates! Learn about your customers and present relevant products to them based on their preferences and buying history in order to remain relevant and keep them interested in what you have to say.

Dosage: repeat once a month

Further reading:

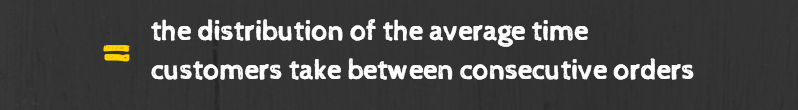

What this tells us: by analysing the average time between consecutive orders for the whole or segments of our customers base, we can start to understand customer purchasing patterns better (and create more effective marketing campaigns).

The ultimate goal is to use this information to avoid bombarding your audience unnecessarily, help prevent churn risk, and be more relevant: the crucible of marketing.

For instance, if a customer has made three purchases, with the second purchase made 45 days after their initial order, and the third purchase made 55 days after the second order, their average order gap is 50 days.

Once you figure out the phases of a customer’s lifecycle, then you can determine what types of messaging to offer at various points in their relationship with your brand, in order to reach customers when they are most likely to buy again – the perfect opportunity for a relevant email campaign with offers or promotions.

Dosage: once a quarter/twice a year

Further reading:

How this helps us: in theory it represents how much each customer is worth in monetary terms, and therefore how much a marketing department should be willing to spend to acquire each customer.

For instance (assuming you have a lonely two customers) if one spent £30 two years ago, £40 last year and £50 this year – their lifetime value is £120 and the second spent £40 two years ago and £40 this year – their lifetime value is £80.

This gives you an average customer lifetime value of £100.

Many retailers know their average CLV, but to truly create personalised marketing campaigns, you need to know much more than this. For example, you can determine CLV for various segments and personas based on purchase history, which will provide you with a wealth of information for creating targeted email messages.

As with anything, it depends on the type of business you’re in. A bed retailer should (hopefully) have a large repeat cycle, whereas an online toothpaste merchant (for example) would have have short repeat rate.

Dosage: once a quarter/biannually

Further reading:

It’s easy in ecommerce to forget that your metrics are alive – datasheets represent real human beings, with unique patterns, shopping behaviours (and mood swings).

We could all do a little more to improve our health, one less office biscuit, fewer weekend beers: but life happens.

Don’t let your customer health succumb to the vices of mankind: perfrom regular audits based on these fundamental metrics in order to stay alive, aware and profitable.

Ometria is committed to protecting and respecting your privacy, and we’ll only use your personal information to administer your account and to provide the products and services you requested from us. You may unsubscribe from these communications at any time. For information on how to unsubscribe, as well as our privacy practices and commitment to protecting your privacy, please review our Privacy Policy.

Take the first step toward smarter customer marketing